update on irs unemployment tax refund

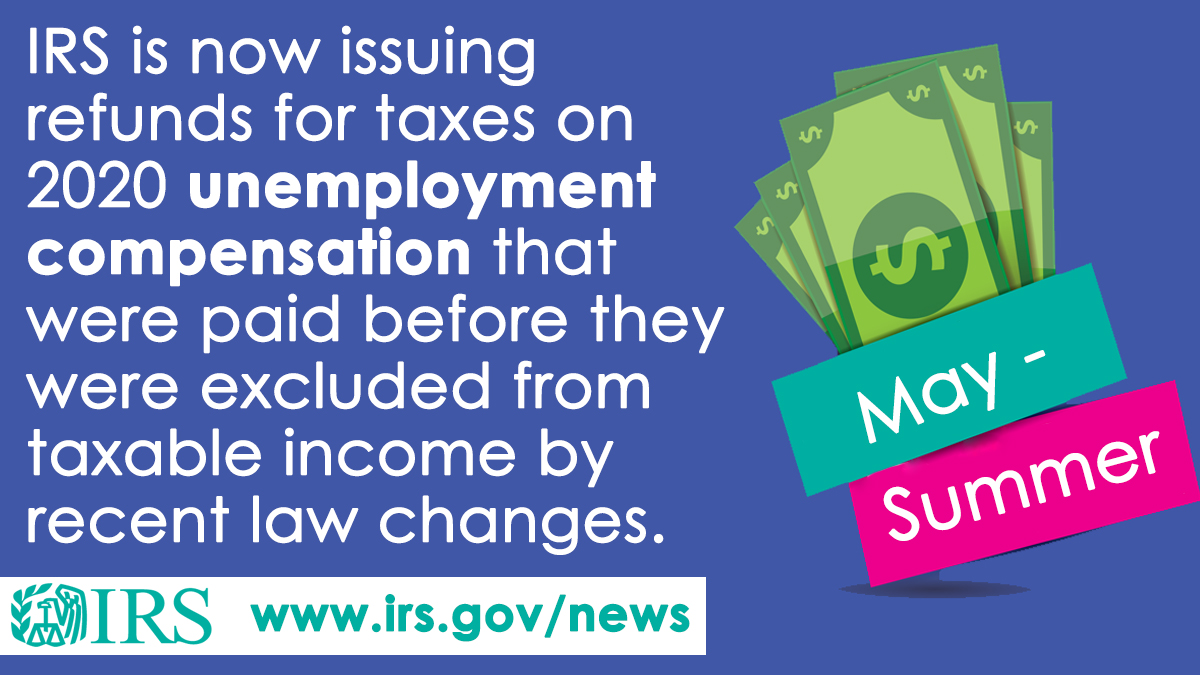

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of unemployment compensation paid in 2020. Only the employer pays FUTA tax.

Irs To Send Another 4 Million Tax Refunds To People Who Overpaid On Unemployment Cbs News

For a list of state unemployment tax agencies visit the US.

. It is not deducted from the employees wages. Similarly to its W-4 counterpart which adjusts tax withholding on wages and salaries based on a table Form W-4V is designed to arrange automatic withholding on different types. Department of Labors Contacts for State UI Tax Information and Assistance.

Fastest federal tax refund with e-file and direct deposit. Form W-4V is the form used to voluntarily request federal income tax withholding on government paid income such as Social Security benefits or unemployment compensation. New tax laws and mandates to pay stimulus checks exclude unemployment income in 2020 and child tax credits in advance have also diverted the IRS focus and extended processing times.

Even though some of these changes were only temporary the IRS processes and antiquated systems have been unable to keep up resulting in more manual reviews. Here are 10 of the most common reasons IRS money is delayed this year. The 310 code simply identifies the transaction as.

Fastest Refund Possible. The IRS issues more than 9 out of 10 refunds in less than 21 days. Most employers pay both a Federal and a state unemployment tax.

Just be aware that your tax transcript does update regularly during tax season so should using in conjunction with the WMRIRS2Go refund trackers in addition to any official correspondence or updates. Tax refund time frames will vary. If you receive your tax refund by direct deposit you may see IRS TREAS 310 listed in the transaction.

For more find the best free tax software see how to track your refund to your bank account or mailbox and learn how to. An example of using your tax transcript to get IRS payment information was provided by some readers around their economic impact payments stimulus. For more information refer to the Instructions for Form 940.

This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only.

6 811 Irs Refund Photos Free Royalty Free Stock Photos From Dreamstime

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Irs Sends First Unemployment Tax Refunds But Automatic State Refunds Are In Limbo Mlive Com

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

More Of Those Surprise Tax Refunds Go Out This Week The Irs Says Will You Get

Irs Sends Out 1 5 Million Surprise Tax Refunds

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Unemployment Tax Refund Update What Is Irs Treas 310 11alive Com

2 8 Million People Are Getting Irs Refunds This Week 10 Million More May Get Money Too Wbff

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Irs Says Unemployment Refunds Will Start Being Sent In May Here S How To Get Yours

When Will Irs Send Unemployment Tax Refunds 11alive Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Interesting Update On The Unemployment Refund R Irs

Irsnews On Twitter Irs Is Correcting Tax Returns For Unemployment Compensation Income Exclusion The First Adjustments Are For Single Taxpayers Who Had The Simplest Tax Returns This Could Result In Refunds For

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Still Haven T Received Unemployment Tax Refund R Irs

Confused About Unemployment Tax Refund Question In Comments R Irs

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates